Perfect Tips About How To Handle Bad Checks

Try to be patient and give your customer the benefit of the doubt.

How to handle bad checks. Make sure the information on the id matches the information on the check. You can do this even if they eventually pay you back. From the id, write on the check.

The rest you keep as your payment. Take note that for bank fees, quickbooks creates a bank service charge expense account if you don’t have. In most cases, the creditor will be able to add double the amount of the check (up to $500) and a bad check administration fee of $25 as a statutory bad check penalty.

If they don’t have the right amount of money available yet, they may still have it in the near future. Applicability to electronic transfers of funds (1) if a check, draft or order is made, drawn, issued, uttered or delivered in violation of. There are several ways business owners can collect on bad checks, including calling the customer, sending a certified letter, or contacting the bank.

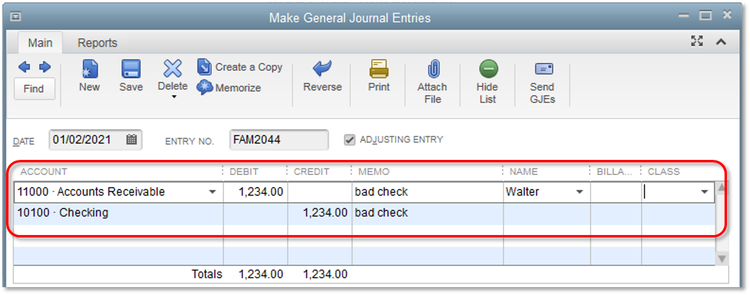

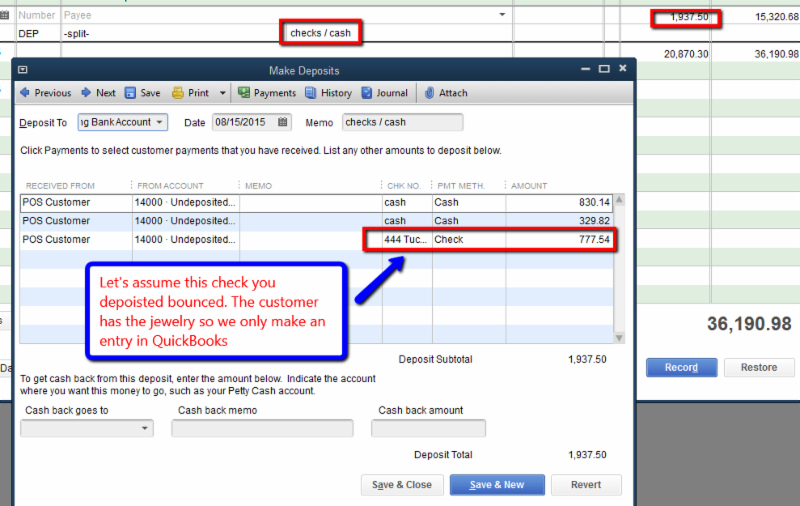

Find and open the check, then select bounced check. It could just be that the account didn’t have enough funds yet when you first attempted to. Issuing a bad check is classified as a petty offense.

Once the cash is withdrawn and sent, you. 6 ways business owners can collect on bad checks 1. Don’t rely on money from a check unless you know and trust the person you’re dealing with.

If you have a bad check, you have to send the following statutory notice that needs to be given and sent ideally via certified mail and u.s. Create and send the treasurer's report of estimated payment bad checks to virginia tax (376.05 kb) handle bad checks for which a replacement payment is. First, check the customer’s texas driver license or id card.